Download the Excel template to consolidate tax declaration data

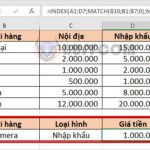

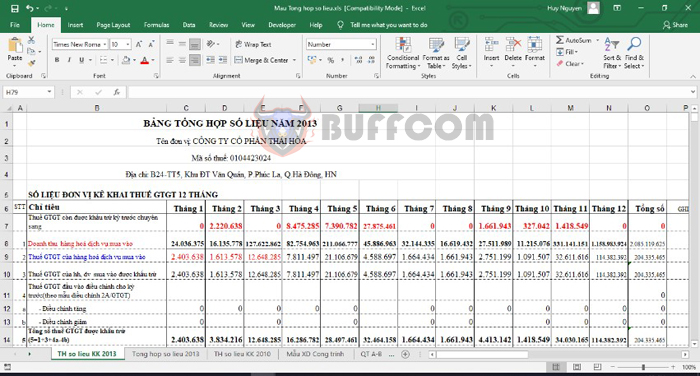

Tax declaration is a regular accounting task that must be done monthly, quarterly, and annually. In this article, Buffcom.net will share with readers an Excel template for consolidating tax declaration data to help accountants easily check tax declaration data.

Steps to check the declared tax data:

-

1. Value-added tax

- Check if the value-added tax declaration for the month (quarter) has been fully submitted;

- Check if the data on the purchase and sale invoice list matches the value-added tax declaration for the month (quarter) and the balance of accounts 133, 3331 in the ledger;

- Check if the additional, adjusted, increased or decreased declaration forms are prepared in accordance with regulations;

- Check if the invoices are complete according to the invoice list; If any are missing, they need to be reviewed or reported as lost invoices to the tax authority;

- Check the tax declaration for the contractor tax and incidental taxes;

- Check the report on the use of invoices

- Check if the report on the use of invoices for the month (quarter) has been fully submitted;

- Check if the issued invoices have been notified;

- Check if the report on the use of invoices for the month (quarter) matches the invoices used in the period; If any invoices have been cancelled, make sure the minutes of the invoice withdrawal are complete and if not, they need to be supplemented.

2. Personal income tax

- If there are deductions for personal income tax for newly employed workers during the declaration period, a personal income tax declaration form must be submitted.

- Check if the number of employees with labor contracts, the taxable personal income tax amount, and the deducted personal income tax amount on the salary sheet match;

- If there are payments for wages to new employees during the financial year, a personal income tax settlement declaration form must be submitted.

- Check if the personal income tax settlement declaration form matches the salary sheet and ledger 334 details;

- Check if employee information such as name, tax code, and dependent information are accurately declared;

- Check if the deducted insurance amounts match the insurance records.

3. Corporate income tax

- Check if the annual income tax settlement declaration form has been submitted;

- Based on the financial report prepared, check according to the corporate income tax law (Circular 96/2015/TT-BTC), for example, some criteria such as:

- Deductible and non-deductible expenses when settling taxes;

- Adjusted increased or decreased profits before tax;

- Loss transfer rules;

- Cases of tax incentives, reductions or exemptions.

Download the Excel template to consolidate tax declaration data