How to calculate Net Present Value (NPV) in Excel

The NPV function in Excel is used to calculate the net present value. The net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows. Please read on to learn how to calculate the NPV in Excel.

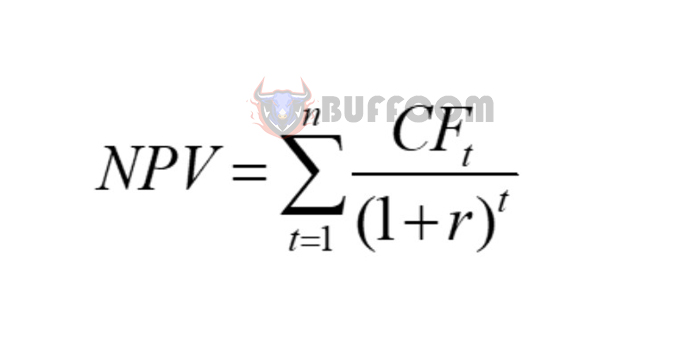

The formula for calculating net present value (NPV).

Net Present Value (NPV) is the present value of a investment. With the help of NPV, investors can calculate the difference between the present value of cash inflows and the present value of cash outflows. This helps them make decisions on whether to invest in a project or not.

The NPV is calculated using the following formula:

To calculate the Net Present Value (NPV) in Microsoft Excel:

Where:

+ NPV: The net present value of the investment project.

+ CFt: The net cash flow of the investment project in year t.

+ n: The life of the investment project.

+ r: The discount rate (usually calculated based on the cost of capital of the project or the rate of return that investors require).

Calculating NPV in Excel

To better understand NPV, let’s look at the following example:

Mr. A plans to buy a truck to transport goods. The expected period of use is 5 years. Each year, Mr. A will receive a net revenue of 150,000,000 VND. The discount rate is 12%/year. Should Mr. A buy this truck or not?

We will use the net present value method to solve this problem. In Excel, you can calculate NPV manually or use the NPV function.

Do not use NPV function

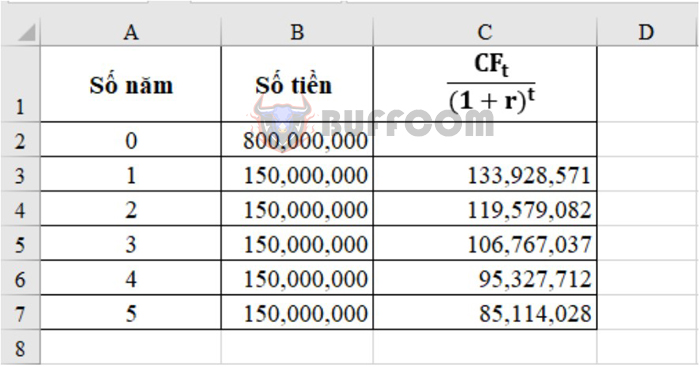

Step 1: Calculate the value of each year.

How to calculate Net Present Value (NPV) in Excel

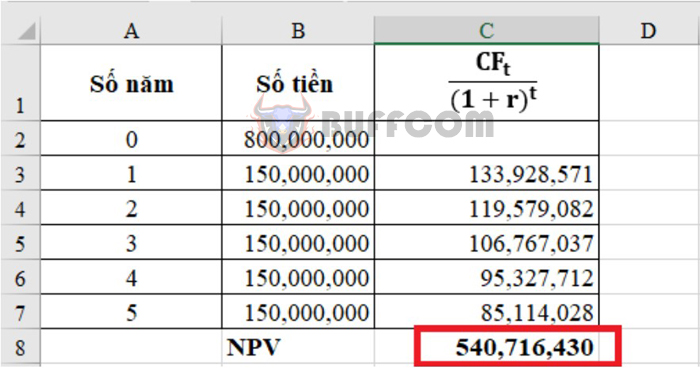

Step 2: Calculate the sum of 7 years. This sum is the NPV of the investment of 800,000,000.

How to calculate Net Present Value (NPV) in Excel

Step 3: Make a decision. As we can see, the net present value of the investment is only 540,716,430, which is less than the capital that Mr. A invested, which is 800,000,000. Therefore, Mr. A should not buy this truck.

Using NPV function

Using the NPV function to calculate net present value will be much simpler than the above method. First, let’s learn about the syntax of the NPV function.

=NPV (rate,value1,[value2],…)

Where:

rate: Discount rate (in the example above, it is 12%).

value1, 2, 3: Cash flow in each year 1, 2, 3… (in the example above, it is 150,000,000 dong).

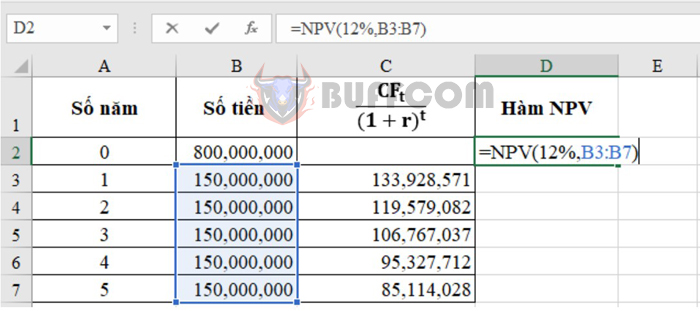

The NPV function is used with the example above as cell D2 below:

How to calculate Net Present Value (NPV) in Excel

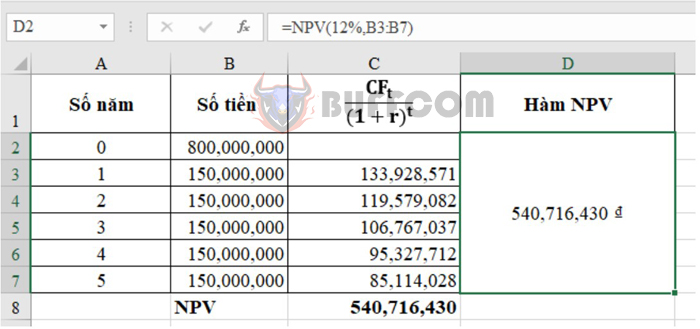

Press Enter to get the result, which is the same as the method without using the function above, but this way is much simpler.

How to calculate Net Present Value (NPV) in Excel

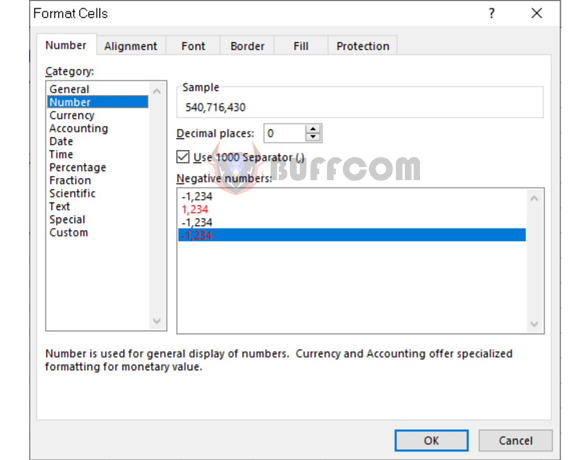

The NPV function result will be returned in Currency format. To change the format of this cell, select the result cell, press Ctrl + 1. The Format Cells dialog box will appear. You can change it to Number format or other formats as desired.

How to calculate Net Present Value (NPV) in Excel

The above is how to calculate NPV in Excel. Please refer and apply it. Wish you success.