How to Calculate Compound Interest in Excel

How to Calculate Compound Interest in Excel

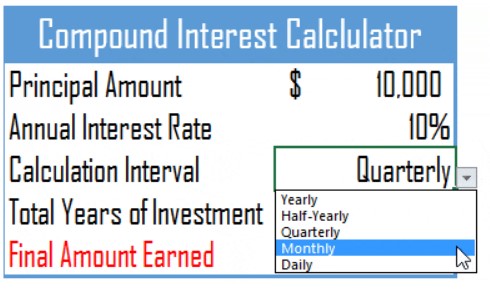

Compound interest is a crucial financial calculation that is frequently used, and it is important to learn how to calculate it in Excel. Before delving into the calculations, it is essential to understand what compound interest actually is. Compound interest refers to the interest calculated on both the initial principal amount and the accumulated interest from previous periods of a deposit or loan.

In Excel, calculating compound interest is straightforward. You need to use a specific calculation method and specify the time period for which you want to calculate the interest. In this post, I will demonstrate how to calculate compound interest in Excel for different time periods. Let’s begin.

How to Calculate Compound Interest in Excel

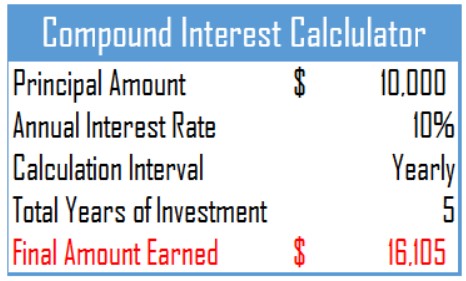

Yearly Compound Interest Formula:

To calculate yearly compound interest, you need to add the interest earned in one year to the principal amount for the next year, thus calculating the interest for the subsequent year. The formula for calculating yearly compound interest in Excel is as follows:

How to Calculate Compound Interest in Excel

=Principal Amount * ((1 + Annual Interest Rate / 1) ^ (Total Years of Investment * 1))

For example, using a principal amount of $10,000, an annual interest rate of 10%, and a 5-year investment period, the calculated compound interest will be $16,105. In the first year, the interest earned is $10,000 * 10% = $1,000, and in the second year, it becomes ($10,000 + $1,000) * 10% = $1,100, and so on.

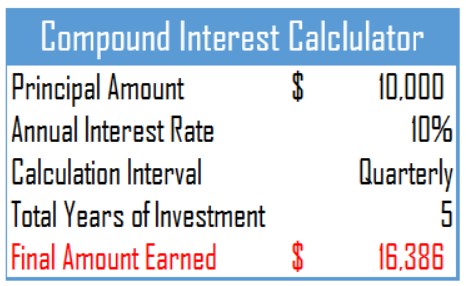

Quarterly Compound Interest Formula:

Calculating quarterly compound interest follows a similar pattern to yearly compound interest. However, you need to calculate the interest four times a year, and the interest amount for each quarter is added to the principal amount for the subsequent quarter. The formula for calculating quarterly compound interest in Excel is as follows:

How to Calculate Compound Interest in Excel

=Principal Amount * ((1 + Annual Interest Rate / 4) ^ (Total Years of Investment * 4))

For instance, using a principal amount of $10,000, an annual interest rate of 10%, and a 5-year investment period, the calculated compound interest will be $16,386. In the first quarter, the interest earned is $10,000 * (10% / 4) = $250, and in the second quarter, it becomes ($10,000 + $250) * (10% / 4) = $256, and the same calculation method applies for 20 quarters (5 years).

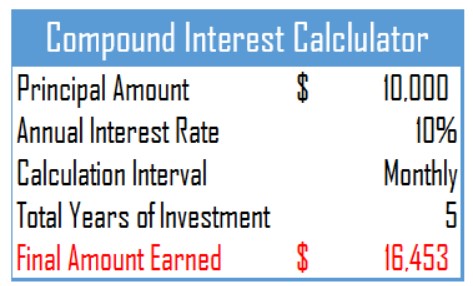

Monthly Compound Interest Formula:

When calculating monthly compound interest, you follow the same principles as in other time periods. You calculate the interest at the end of each month, and the interest rate is divided by 12 to obtain the monthly interest rate. The formula for calculating monthly compound interest in Excel is as follows:

How to Calculate Compound Interest in Excel

=Principal Amount * ((1 + Annual Interest Rate / 12) ^ (Total Years of Investment * 12))

For example, using a principal amount of $10,000, an annual interest rate of 10%, and a 5-year investment period, the calculated compound interest will be $16,453. In the first month, the interest earned is $10,000 * (10% / 12) = $83.33, and in the second month, it becomes ($10,000 + $83.33) * (10% / 12) = $84.02, and the same calculation applies for 60 months (5 years).

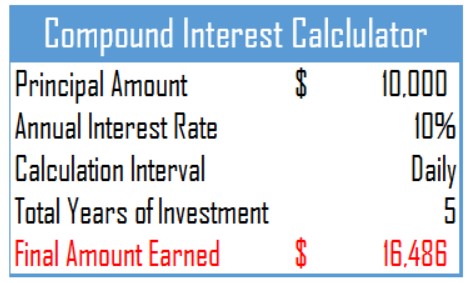

Daily Compound Interest Formula:

When calculating daily compound interest, you use the same principles, but with a daily interest rate obtained by dividing the annual interest rate by 365. The formula for calculating daily compound interest in Excel is as follows:

=Principal Amount * ((1 + Annual Interest Rate / 365) ^ (Total Years of Investment * 365))