How to use the NPER function to calculate the number of periods of an investment in Excel

How to use the NPER function to calculate the number of periods of an investment in Excel: The NPER function is widely used in Excel to calculate the number of periods of an investment. The NPER function is useful in many different fields such as finance, accounting, etc.

1. NPER function structure

Function syntax: =NPER(rate, pmt, pv, [fv], [type])

Where:

- Rate: required argument, is the interest rate per period.

- Pmt: required argument, is the payment for each period.

- Pv: required argument, is the present value or the amount of cash now, equivalent to a series of future payments.

- Fv: optional argument, is the future value or the remaining cash balance you want to have after the final payment.

- Type: optional argument, is the timing of payments.

Note:

- Pmt remains the same during the entire period. The pmt argument includes principal and interest, but does not include other fees and taxes.

- If fv is omitted, it is assumed to be 0 (for example, the future value of a loan is 0).

- If the Type argument is 0 or omitted, it means the payment is due at the end of the period.

- If the Type argument is 1, it means the payment is due at the beginning of the period.

2. How to use the NPER function

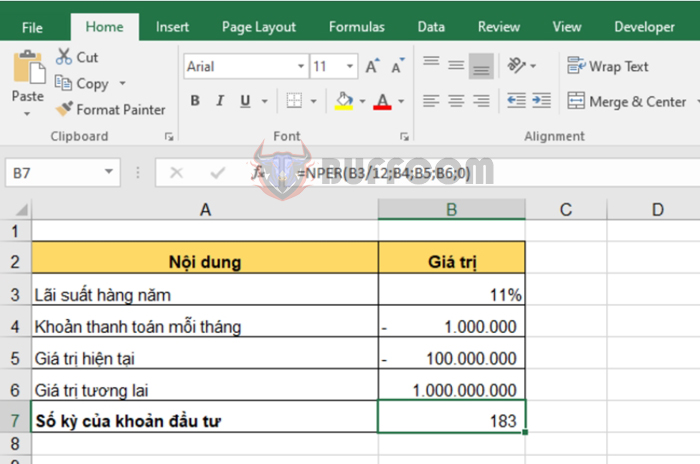

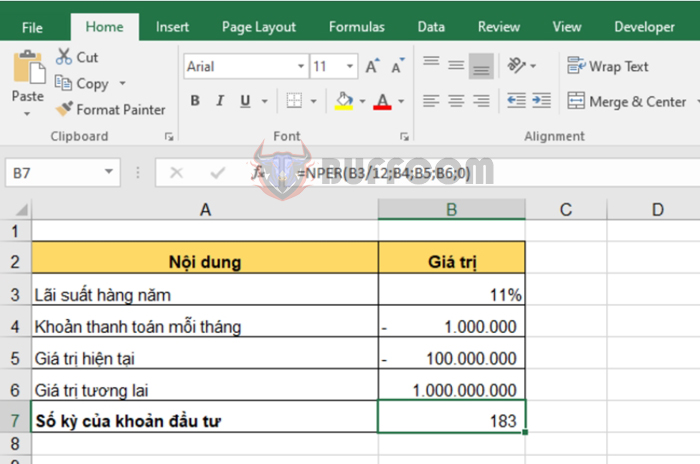

For example, suppose you have an investment worth 100,000,000 with an interest rate of 11% per year. You invest an additional 1,000,000 per month. You want to calculate how long it takes for the investment to reach a value of 1,000,000,000.

How to use the NPER function to calculate the number of periods of an investment in Excel

Using the above function structure, the formula to calculate the number of periods needed for the investment to reach the desired value is:

=NPER(B3/12,B4,B5,B6,0)

The result is that it takes 183 months for the investment to reach the desired value of 1,000,000,000.

In conclusion, this article has provided a good guide on how to use the NPER function in Excel to calculate the number of periods of an investment. However, if you want to calculate the number of periods over a different time period or with uneven payments, you can adjust the input values in the function to suit your specific case.